U.S. President Donald Trump’s threat to more than double American tariffs on Chinese goods if an agreement isn’t reached by March 1 would escalate a bruising trade war that’s shaken the world economy and caused companies to reconfigure their supply chains. - Bloomberg.com

1. What’s so important about March 1?

That’s the end of a 90-day truce that Trump and China’s Xi Jinping agreed toin December. The U.S. agreed then to delay a planned increase, to 25 percent from 10 percent, in tariffs on almost half the goods the U.S. buys from China, worth some $200 billion. American and Chinese officials have been negotiating since then. With Trump and Xi both reporting progress, Trump is said to be considering pushing back the deadline by 60 days.

2. How else might this escalate?

If Trump goes forward with the higher 25 percent tariffs, China could reply with countermeasures, and that could prompt Trump to follow through on threats to slap duties on a further $267 billion of goods.

|

| Photographer: Qilai Shen/Bloomberg |

3. What’s the risk for the U.S.?

American shoppers have been mostly insulated from the trade war, since inflation remains tame and the tariffs haven’t hit staples like clothing, footwear and toys. That could change. A January report by Bank of AmericaCorp. analysts said any escalation of the trade war “would be much more painful” for the U.S., triggering renewed market volatility and undermining investor confidence.

4. What’s the risk for China?

An escalation would deepen the slowdown in economic growth and raise pressure on the government to respond with higher public spending. That would likely be funded by debt, undermining the government’s quest to reduce the country’s heavy debt burden. Bloomberg Economics estimates China would avoid a 0.3 percent drag on 2019 gross domestic product if the trade truce holds. Their base case -- assuming an escalation is avoided -- is for economic growth in China to slow to 6.2 percent in 2019, down from 6.6 percent in 2018.

5. What are the sticking points to a deal?

Enforcement, intellectual-property protection and technology. Trump has pledged that any deal will contain “strong enforcement language,’’ yet his aides are still figuring out what that should be -- and how to get China to sign off. The World Trade Organization is one possible arena for policing a deal, but the U.S. administration has shown little patience for it. It’s tough to see what the Chinese side will agree to beyond promises to buy more U.S. goods, given their denials regarding forced technology transfers or other alleged misbehavior. (The widening U.S. government crackdown on Huawei Technologies Co., a Chinese telecommunications giant, underscores the challenge.) The two sides were said to remain far apart on structural reforms to China’s economy that the U.S. has requested.

6. Why are we in a trade war?

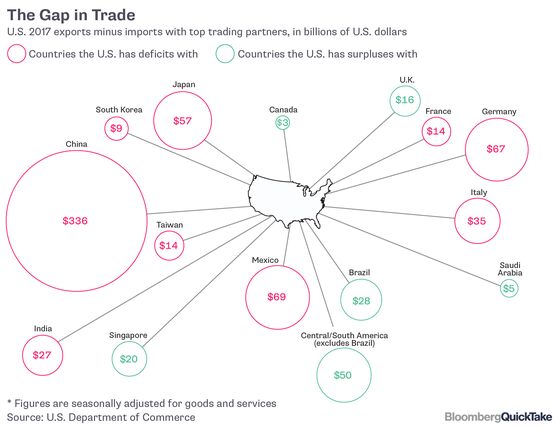

Trump routinely points to the large U.S. trade deficit, the difference between imports and exports, as a symbol of a declining manufacturing base and the loss of American might. He aims to reduce the goods-and-services gap with China, which totaled $566 billion in 2017, by both browbeating and enticing U.S. companies to import less and export more. In addition to goods from China he’s imposed tariffs (which act like a tax on imports) on steel and aluminum from countries including allies Canada, Mexico and the European Union.

7. Will Trump’s strategy work?

It depends on who blinks first. China has agreed in principle to increase imports of U.S. agricultural products, along with energy, industrial products and services as part of a path to eliminate its U.S. trade imbalance. That promise might form the basis of a preliminary agreement, though the tariffs may stay in place while the two sides work out differences in tougher issues such as the heavy involvement of the state in China’s economy. Trump’s threat to abandon the North American Free Trade Agreement prompted Canada and Mexico, the two other signatories of that treaty, to agree to revisions. Tariffs on metals and threatened duties on cars had the EU and Japan also looking to deal.

8. What’s been the impact so far?

Investors and executives routinely cite the trade war between the world’s two biggest economies as one of the biggest threats to all kinds of businesses. The International Monetary Fund, cutting its forecast for the world economy for the second time in three months due in part to trade tensions, said in January that global growth would be 3.5 percent in 2019. Meanwhile the U.S. trade deficit widened in 2018, partly because the stronger dollar made U.S. exports pricier.

9. What are companies saying?

It depends on what you sell. Apple, Starbucks, Volkswagen and FedEx are among those to have cited a slowing Chinese economy in their outlooks. More than 400 publicly traded Chinese companies warned on their earnings. While the trade war is only one factor that’s weighing on demand -- weakness in Europe and the impact of fading U.S. fiscal stimulus are others -- it’s probably the issue that most concerns executives. Some are even looking at uprooting their supply chain. Some businesses in Southeast Asia expect China’s pain to be their exporting gain. Metals tariffs have helped producers with American plants, such as ArcelorMittal, U.S. Steel and Nucor. They’re charging higher prices, and some have reopened shuttered sites. But some U.S. business groups say the tariffs and retaliatory duties have hurt American industry, farmers and workers.

- by B L O O M B E R G

Kiss the Son, lest he be angry,

and ye perish from the way,

when his wrath is kindled but a little.

Blessed are all they

that put their trust in him.

(Psalm 2:12)

**

No comments:

Post a Comment